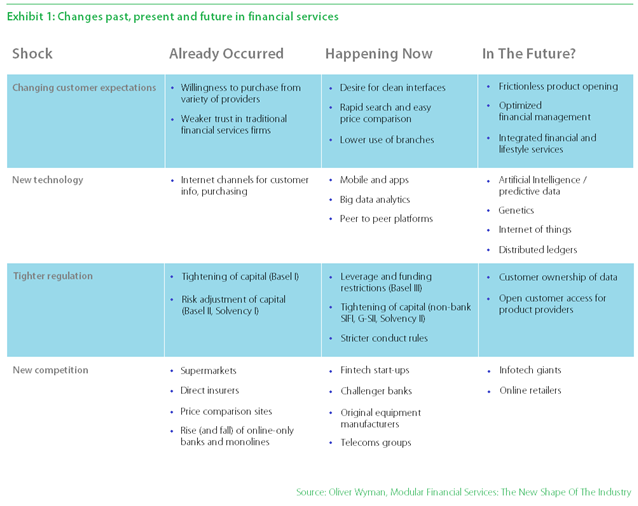

Since the late 90s, banks and other financial institutions have witnessed a steep decline in customer loyalty. With high fixed costs due to branches and personnel, the traditional options are no longer as appealing to consumers as they once were before.

The financial industry as a whole is becoming more modular, which means that in any major transaction, no single supplier will have sole ownership over a customer—clients will be able to pick and choose from multiple providers. Customers are taking advantage of digital technology to reduce costs of transactions while using mobile applications or platforms to achieve greater levels of familiarity and convenience. Already, some firms are having to make adjustments by settling for smaller roles in a customer's purchasing journey.

Modularity in the Financial Sector

So, what does this all mean for big banks, challenger start-ups and consumers? We offer 4 key takeaways for modularity in the financial sector.

1. Operating platforms must undergo transformation

Many large banks and insurers are operating with legacy systems that are costly and outdated. These old, inflexible processes will drive costs through ongoing maintenance and additional "add-ons," ultimately proving to be unsustainable in the long run. Of course, some firms will attempt to outsource this work for standardized processes (e.g., loan payments processing), but the majority will be tasked with having to completely rebuild their internal systems from the ground up. The challenge is great, but there's certainly a great upside to this—everything from cost savings due to reduced IT maintenance costs to less operational risks moving forward. Either way, firms will need to find an answer for their platforms or risk becoming obsolete.

2. Organizational leadership needs to evolve, too

We've explored this point in other posts. Digital transformation doesn't merely occur with a new product offering or IT implementation, as important as that is. But a real transformation involves a complete shift in business strategy, and it has to impact the organization from top to bottom, starting with the top executives. They'll need to embrace a customer-centric mindset that puts a premium on customer experience over immediate ROI. This includes everything from rearranging teams and hiring the right talent, to rewiring business operations across the entire organization. It could also mean determining overall weaknesses and strengths, then seeking opportunities to invest, expand and strategize with external partners to achieve greater revenues.

3. Modular markets won't be immune to difficulty

Fintech start-ups and other challenger banks have been capitalizing on this movement, but the fact remains: big, traditional firms still hold an advantage. The barrier of entry for new entrants is high, especially when you consider having to deal with current regulatory compliance, existing customer bases, secure environments and proper distribution channels. The firms that are looking to stay one step ahead will need to manage their operations and invest in creative digital strategies that allow future flexibility. This could mean partnering with new capital and infrastructure suppliers, lowering overhead and operating costs, and discovering new ways to access more potential clients.

4. Customers are the clear-cut winners

As the entire industry becomes modularized, it will also be more streamlined and accountable. Firms will become more transparent about their pricing, which will invite competition from both new entrants and old stalwarts. This means business will be driven towards those who simply offer the best overall product or service experience. With lower costs, faster operations, and better service in the horizon, consumers certainly stand to win the most.

Granted, it's hard to predict just how much of an impact modular services will have on the financial sector. Factors such as consumer behavior, regulatory compliance and disruptive technology are key variables that must be considered.

But what's for certain is that staying stagnant is no longer an option. Companies need to undergo a ground-up evaluation and reconstruction of their strategy, starting with their legacy systems and back office operations.

The industry is changing—the customers are no longer waiting.