This is part two of a three-part series, based on insights found in the benchmark report Assessing the Digital Landscape for Financial Institutions: How to Lead the Charge With People and Technology.

Read Part One - Want Better Customer Experience? Create a Cross-Function Team - and Part Three - Jumpstart Your Omnichannel Experience by Asking These Four Questions - to learn more today.

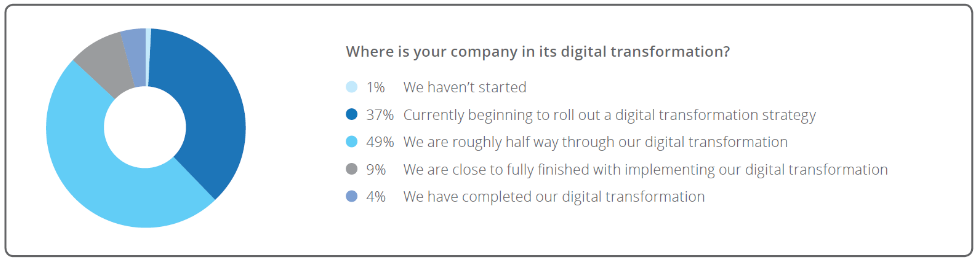

It’s no secret that digital transformation is a necessity for long-term, traditional players in business, if they want to stay relevant to consumers. In a recent study of financial service leaders, 49% of respondents stated they were roughly halfway through digital transformation, and an additional 37% were in early stages. The fact that so many leaders are making inroads in digital innovation is a good sign for financial services. It means that they’re paying attention and preparing for any coming disruption.

However, being “roughly halfway” through digital transformation means that FSI still has a long way to go. The numbers around customer experience improvement efforts hint at some of the remaining obstacles in transformation. Of those surveyed, 55% are currently working on coordinating their customer experience across channels, and 36% are gearing up to begin this work.

This means that, except for a few leaders and laggards, financial services are in the middle of redesigning their customer experience or about to start. In order to sustain this great momentum and not get stuck, FSI should look to examples from other industries that are farther along in the digital transformation process.

Here are three lessons from the retail and food industries to help financial services carry digital innovation into customer experience.

Lesson One: Pay Attention to Micro-Moments

Google has identified different kinds of micro-moments, which it defines as “moments that decisions are made and preferences are shaped.” One fun example of this from the food industry is Taco Bell’s TacoBot. It integrates with Slack so that you can order food through an instant message. Since Slack is primarily used as a work tool, this is an innovative way to capture the moments when hunger is setting in during the work day.

Or take, for example, what Google calls I-want-to-know and I-want-to-go moments. Consumers are searching for information on their mobile phones the moment a question occurs to them, and searches that include “near me” have doubled in the past year. Banks could take advantage of this through mobile apps that use geo-location to let customers know that they are nearby and available to help with any financial questions they have.

Lesson Two: Find Technology That Makes Brick and Mortar Stand Out

With the rapid rise of IoT gadgets and VR technology, retail companies have to be brutal about which digital trends are worth pursuing and which will fade away. The point of coordinating customer experience across digital and physical environments is to “help the physical, brick and mortar, three-dimensional retail environment distinguish itself from an online experience,” according to a recent article on Forbes. Currently, consumers still depend on in-person interactions for many of their finance needs. Financial services companies need to establish processes for evaluating technology that enable them to both boost their digital channels, as well as redesign their physical locations so that all touchpoints are seamless, easy to use and valuable for their customers.

Lesson Three: Culture is Hard to Change

People don’t like it when things change. In 2011, JCPenney launched a digital initiative that failed spectacularly, leading some to conclude that its digital strategy was flawed. But when you look at the department store today, they’ve implemented many of the digital initiatives that were attempted five years ago. This suggests that the obstacles they faced were about people and culture, not technology or strategy. See this recent interview with Lance Thornswood, the Senior Director of JCPenney’s omnichannel digital platform. He states that, even when initiatives were successful, trying to create a new work culture “pushed people so outside their comfort zones that the natural tendency was to snap back to the old ways.” He goes on to say that seeking consensus within the company leads to risk-aversion and stops innovation in its tracks. Instead, executives should empower their employees to pursue new ideas that they really believe in. This creates a more optimistic culture that doesn’t condition employees to say “no” to risk. Financial service leaders need to be aware of the resistance to change within their own companies and find ways to guide their employees through the transition.

Final Takeaway

There’s one more thing that financial service leaders can take from the final JCPenney example: it’s not too late to change. Even if your company is stalled on digital transformation and customer experience improvement, it might not be too late to recover. It will take time and coordination across your organization, but hopefully, these lessons from those who’ve been there will inspire you to keep pressing forward.

Assessing the Digital Landscape for Financial Institutions: How to Lead the Charge With People and Technology

Download the Full Report

See why Liferay is named a leader for the 7th consecutive year in Gartner's Magic Quadrant.